Dental implants and crowns are significant dental procedures that can enhance oral function and aesthetics. However, they often come with a hefty price tag. Dental insurance can potentially alleviate the financial burden, but not all plans provide coverage for these specific treatments. As the demand for implants and crowns grows, it becomes crucial to identify the dental insurance options that offer the most suitable coverage.

Understanding Dental Implants and Crowns Coverage

Dental Implants:

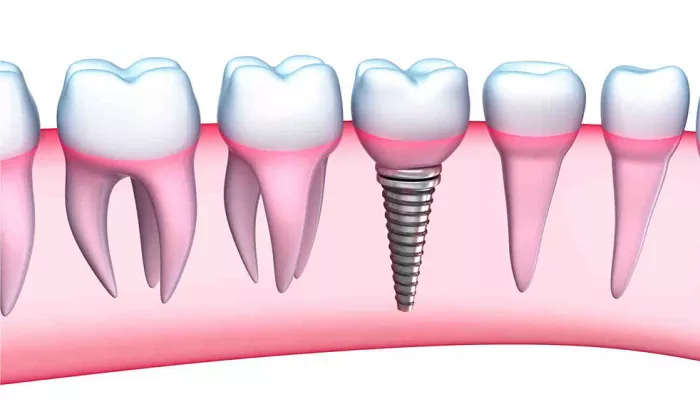

Components and Cost: Dental implants consist of a titanium post surgically placed into the jawbone, an abutment, and a crown. The overall cost can range from a few thousand to several thousand dollars per implant, depending on various factors such as location, dentist’s expertise, and any additional procedures required, like bone grafting.

Coverage Considerations: Some dental insurance plans may cover a portion of the implant cost, including the surgical placement and the crown. However, many plans consider implants as a major dental procedure and have specific limitations. For example, they might cover only a certain percentage, say 50%, of the total cost, or have a maximum annual benefit limit that applies to implant procedures.

Dental Crowns:

Function and Cost: Crowns are used to restore damaged or decayed teeth, providing strength and protection. The cost of a crown can vary, but on average, it can be several hundred to over a thousand dollars per tooth, depending on the material used (e.g., porcelain, metal, or a combination).

Insurance Coverage: Many dental insurance plans offer coverage for crowns, but again, the extent of coverage varies. Some plans may cover a fixed amount per crown, while others may cover a percentage of the total cost. There may also be restrictions based on the reason for the crown, such as whether it’s for a tooth that has had a root canal or is simply damaged.

Types of Dental Insurance Plans

Employer-Sponsored Plans:

Coverage Varies: These plans, which are provided by employers to their employees, can have different levels of coverage for implants and crowns. Some employers may offer more comprehensive plans that cover a significant portion of the costs, while others may have more basic plans with limited coverage. It often depends on the employer’s budget and the negotiated benefits with the insurance provider.

Advantages: They usually have a group rate, which can be more affordable than individual plans. Additionally, the employer may contribute a portion of the premium, reducing the out-of-pocket cost for employees. However, the choice of plans may be limited to those offered by the employer.

Individual Dental Insurance Plans:

Customizable Options: These plans are purchased directly by individuals. They offer more flexibility in choosing the coverage that suits one’s specific needs. Some individual plans may be designed to provide better coverage for implants and crowns, especially if the person anticipates needing these procedures in the near future.

Considerations: Premiums can vary widely based on factors such as age, location, and the level of coverage selected. It’s important to carefully review the policy details, including waiting periods, deductibles, and co-payments, to understand the true cost and benefits of the plan.

Dental Discount Plans:

How They Work: Instead of traditional insurance, dental discount plans offer members reduced rates for dental services at participating dentists. While they don’t technically “cover” the cost of implants and crowns like insurance, they can provide significant savings. For example, a member might get a 20% to 50% discount on the cost of a crown or implant procedure.

Limitations: These plans usually require payment of an annual membership fee, and the savings are only applicable at in-network dentists. They also don’t have the same regulatory safeguards as insurance plans, so it’s crucial to research the reputation and reliability of the discount plan provider.

Insurance Providers and Their Offerings

Major Insurance Companies:

Example 1: Delta Dental: Delta Dental offers a range of plans, some of which may provide coverage for implants and crowns. Their plans typically have a network of dentists, and coverage details can vary. For instance, a higher-tier plan might cover 50% of the cost of a dental implant, including the crown, after meeting the deductible, while a lower-tier plan may offer less coverage or have more restrictions.

Example 2: Cigna Dental: Cigna Dental has various plans with different levels of benefits. Some of their plans cover implants and crowns, but with specific conditions. They may require pre-authorization for implant procedures and have limits on the annual maximum benefit for major dental work.

Specialty Dental Insurance Providers:

Companies Focused on Implant Coverage: There are some insurance providers that specifically target implant coverage. These companies may offer more comprehensive coverage for implants and related procedures, but they may also have higher premiums. For example, some plans might cover up to 70% of the cost of an implant, including the crown, but with a relatively high monthly premium compared to traditional dental insurance.

Evaluating Their Plans: When considering these specialty providers, it’s essential to look at their reputation, customer reviews, and the specific details of the coverage. Some may have limited networks of dentists, so it’s important to ensure that there are qualified providers in your area.

Policy Terms and Conditions

Waiting Periods:

Initial Waiting Period: Most dental insurance plans have an initial waiting period, typically ranging from a few months to a year, before coverage for major procedures like implants and crowns becomes effective. During this time, the plan may only cover preventive and basic restorative services. For example, a plan might have a six-month waiting period for implant coverage, meaning you would have to wait six months from the start of the policy before any implant-related expenses would be eligible for reimbursement.

Treatment-Specific Waiting Periods: In addition to the initial waiting period, there may be specific waiting periods for different stages of the implant or crown process. For instance, there could be a waiting period between the implant placement and the crown placement. Understanding these staggered waiting periods is crucial as it affects the overall timeline and cost of your treatment.

Deductibles and Co-payments:

Deductibles: Dental insurance plans often have a deductible, which is the amount you must pay out-of-pocket before the insurance starts covering the costs. Deductibles for implant and crown coverage can vary widely. Some plans may have a relatively low deductible, say $100 to $500, while others may have a higher deductible, especially for major procedures. For example, a plan might have a $500 deductible for implant-related services, which means you would need to pay the first $500 of the cost before the insurance kicks in.

Co-payments: Co-payments are the fixed or percentage-based amounts you pay for each implant or crown procedure. For example, a plan might require a 20% co-payment for the cost of a crown, with the insurance covering the remaining 80%.Understanding these cost-sharing arrangements is essential to estimate your total out-of-pocket expenses.

Annual Maximum Benefits:

Limitations on Coverage: Most dental insurance plans have an annual maximum benefit limit, which is the total amount the insurance will pay for all dental services, including implants and crowns, in a given year. If the cost of your implants and crowns exceeds this limit, you will be responsible for the remaining balance. For example, a plan might have an annual maximum benefit of $2,000, and if your implant and crown costs total $3,000, you would have to pay the additional $1,000 out-of-pocket.

Strategies to Maximize Benefits: To make the most of your insurance coverage, it’s important to understand the annual maximum and plan your dental treatments accordingly. If possible, spread out major procedures over multiple years to ensure that you can take full advantage of the available benefits each year.

Conclusion

Finding the right dental insurance that covers implants and crowns requires careful consideration of multiple factors. It’s essential to understand the coverage details, the types of plans available, the offerings of different insurance providers, and the policy terms and conditions. By conducting thorough research, comparing different options, and asking the right questions, you can increase your chances of finding a dental insurance plan that provides the coverage you need for implants and crowns while also fitting within your budget. Remember, investing time in choosing the appropriate insurance now can save you from significant financial stress and ensure that you can receive the necessary dental treatments to maintain a healthy and functional smile.